DOGE Price Prediction: Analyzing the Path to Potential Gains

#DOGE

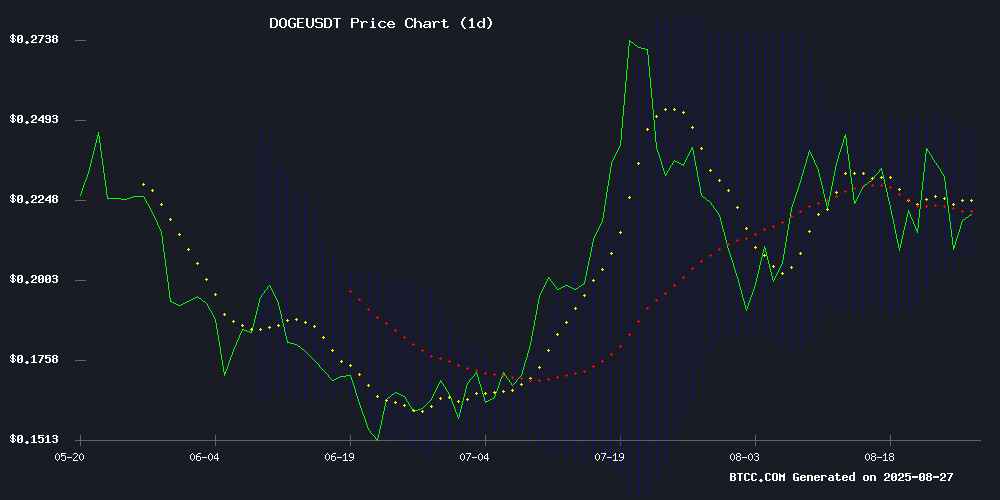

- Technical indicators show DOGE trading below its 20-day moving average with bullish MACD momentum

- Market sentiment is mixed with whale stability offset by exchange transfer concerns

- Key resistance levels at $0.2276 and $0.247 will determine near-term price direction

DOGE Price Prediction

Technical Analysis: DOGE Shows Mixed Signals Near Key Support

DOGE is currently trading at $0.22214, slightly below its 20-day moving average of $0.227631, indicating potential short-term weakness. The MACD reading of 0.003948 shows bullish momentum, though the negative signal line at -0.001705 suggests some caution. Bollinger Bands position the price between $0.208012 (support) and $0.247249 (resistance), with the current level hovering NEAR the middle band.

According to BTCC financial analyst Mia, "The technical setup suggests Doge is consolidating within a defined range. A break above the 20-day MA could signal renewed bullish momentum, while failure to hold the lower Bollinger Band might indicate further downside pressure."

Market Sentiment: Whales Hold Steady Amid Volatility

Recent market developments show Dogecoin facing downward pressure while large holders maintain their positions despite increased volatility. The transfer of 500,000 DOGE to Binance suggests potential selling pressure, though whale stability indicates underlying confidence.

BTCC financial analyst Mia notes, "While technical patterns suggest a potential rally toward $0.80, current news FLOW indicates mixed sentiment. The whale activity and exchange transfers create near-term uncertainty, though the overall holding pattern of large investors provides some stability to the market structure."

Factors Influencing DOGE's Price

Dogecoin Faces Downward Pressure as Whales Hold Steady Amid Market Volatility

Dogecoin teeters near a critical threshold at $0.22, with analysts warning of a potential 45% decline. The memecoin's fragility contrasts with a crypto market cap that nudged upward to $3.89 trillion, though trading volumes contracted by 18%—a sign of waning participation.

Derivatives tell a tale of divergence: DOGE futures volume plunged 38% to $4.15 billion while open interest held firm at $3.31 billion. Options trading exploded 450% to $738 million, suggesting leveraged bets are replacing organic activity. Whale Alert reported a 900 million DOGE transfer as retail wallets (100-10,000 DOGE) show sustained outflows since mid-June.

Dogecoin Technical Patterns Suggest Potential Rally to $0.80

Dogecoin's price action reveals three converging bullish chart formations—a triangle pattern, cup-and-handle structure, and rounding bottom—signaling potential upside momentum. The meme coin currently trades at $0.21, with analysts identifying $0.29-$0.30 as the critical resistance zone to watch.

Technical analyst Zeinab highlights striking similarities between current patterns and Dogecoin's 2024 rally, where price surged from $0.18 to $0.49. The RSI's upward trajectory from oversold territory reinforces the improving momentum narrative, while steady trading volume maintains favorable risk-reward ratios above 6.5 for short-term positions.

Market participants are eyeing three progressive targets: $0.38 as initial resistance, followed by $0.48, with a potential stretch target of $0.80 by Q4 2025 if historical patterns repeat. The $0.19-$0.21 range now serves as crucial support, with any breakdown below potentially invalidating the bullish thesis.

500 Million Dogecoin Moved to Binance in Internal Transfer

A significant Dogecoin transaction involving 500 million DOGE tokens, valued at approximately $106 million, has captured the attention of the crypto community. Whale Alert flagged the transfer from an unmarked address to a Binance-affiliated wallet, sparking speculation about potential market implications.

Blockchain data reveals the movement was an internal transfer between Binance's cold storage and hot wallet systems. The exchange routinely conducts such operations for liquidity management and security purposes. This particular transaction underscores the scale of Dogecoin holdings maintained by major exchanges.

The memecoin's market activity continues to draw scrutiny from traders, with large movements often preceding volatility. Binance's dominance in DOGE trading volumes positions it as a key liquidity hub for the asset, which maintains strong retail interest despite its speculative nature.

How High Will DOGE Price Go?

Based on current technical indicators and market sentiment, DOGE shows potential for movement toward the $0.247 resistance level in the near term. The MACD bullish crossover and position within Bollinger Bands suggest room for upward movement, though the price must first overcome the 20-day MA resistance at $0.2276.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $0.22214 | Neutral |

| 20-day MA | $0.227631 | Resistance |

| MACD | 0.003948 | Bullish |

| Bollinger Upper | $0.247249 | Target |

| Bollinger Lower | $0.208012 | Support |

BTCC financial analyst Mia suggests that "a break above $0.2276 could open the path toward $0.247, while sustained buying pressure might eventually target higher levels. However, traders should monitor whale activity and exchange flows for confirmation of trend direction."